Direct Sales is Considered a Sole Proprietorship for Tax Purposes

Jul 14, 2022

I hear often that tax accountants' advice their clients that they are unable to their Direct Sales business on their taxes, is not considered a business.

In fact, I have heard this so often over the last decade that I dedicated a chapter to my book on the bad advice being given.

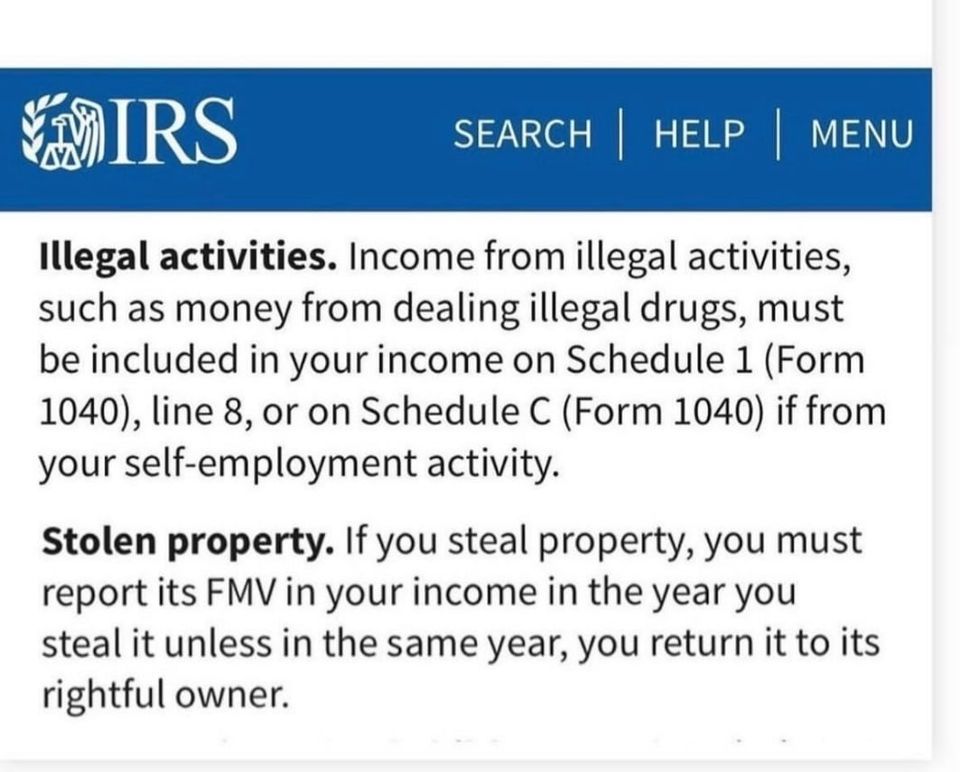

Income is Taxable Regardless of How it is Earned

Any income earned by taxpayer must be reported on their taxes, and this applies to both personal and business income. The Internal Revenue Service (IRS) and Canada Revenue Agency (CRA) has even issued statements to criminals to report their income.

This has been widely reported in the media in both countries like this article reported in CNN Business titled The IRS wants to tax your illegal income and this article by CBC News Canada titled Taxman reminds crooks to declare their income.

Direct Sales is a legitimate business for tax purposes

There are few direct sales companies who issue their independent reps a W2 or T4A (in Canada) for their earnings. This income is commission earned. It is important to note that this is not sales revenue, it is taxable commission income. If a company does not report the commissions on a tax slip, it must still be reported at tax time.

If the Direct Sales company is required to report these commission paid to you as their independent distributor rep, this makes you a sole proprietor, and therefore you can claim home business tax write-offs. As a self-employed individual you report these earnings and home-based business tax write-offs on a Schedule-C in the US or T2125 in Canada.

So if your tax person is saying you cannot claim tax write-offs (even if you have no income in that side business) then find a new tax person! Or better yet, take a serious look at online course and coaching – I’ll change your tax paying future forever!

Direct Sales covers many channels of distribution

To learn more about the Direct Sales Industry, I had the privilege to meet up with Peter Maddox, President of the Direct Sales Association of Canada. In the below video we addressed some of the most common questions and misconceptions about the Direct Sales, and more specifically the terms used as the Network Marketing & MLM industry.

Here is a summary of the interview:

- The difference is between direct sales, multi-level marketing, network marketing, MLM (all loosely used terms). What is a pyramid scheme?

- What are the signs “red flags” of a pyramid scheme that people should watch for?

- Why do they say it's difficult to make money? Is this true?

- What about inventory? What is reasonable (average) for an opening investment and to support an ongoing business?

- If someone were to consider joining a direct sales company. What recommendations would you give them in evaluating a legitimate company?

- DSA Mark of Distinction Award - what is it this and what is the significance in this industry/profession?

Say Goodbye to Tax Stress

Proven Tax Strategies, Audit-Proof Tools, and Year-Round Support for Home-Based Entrepreneurs