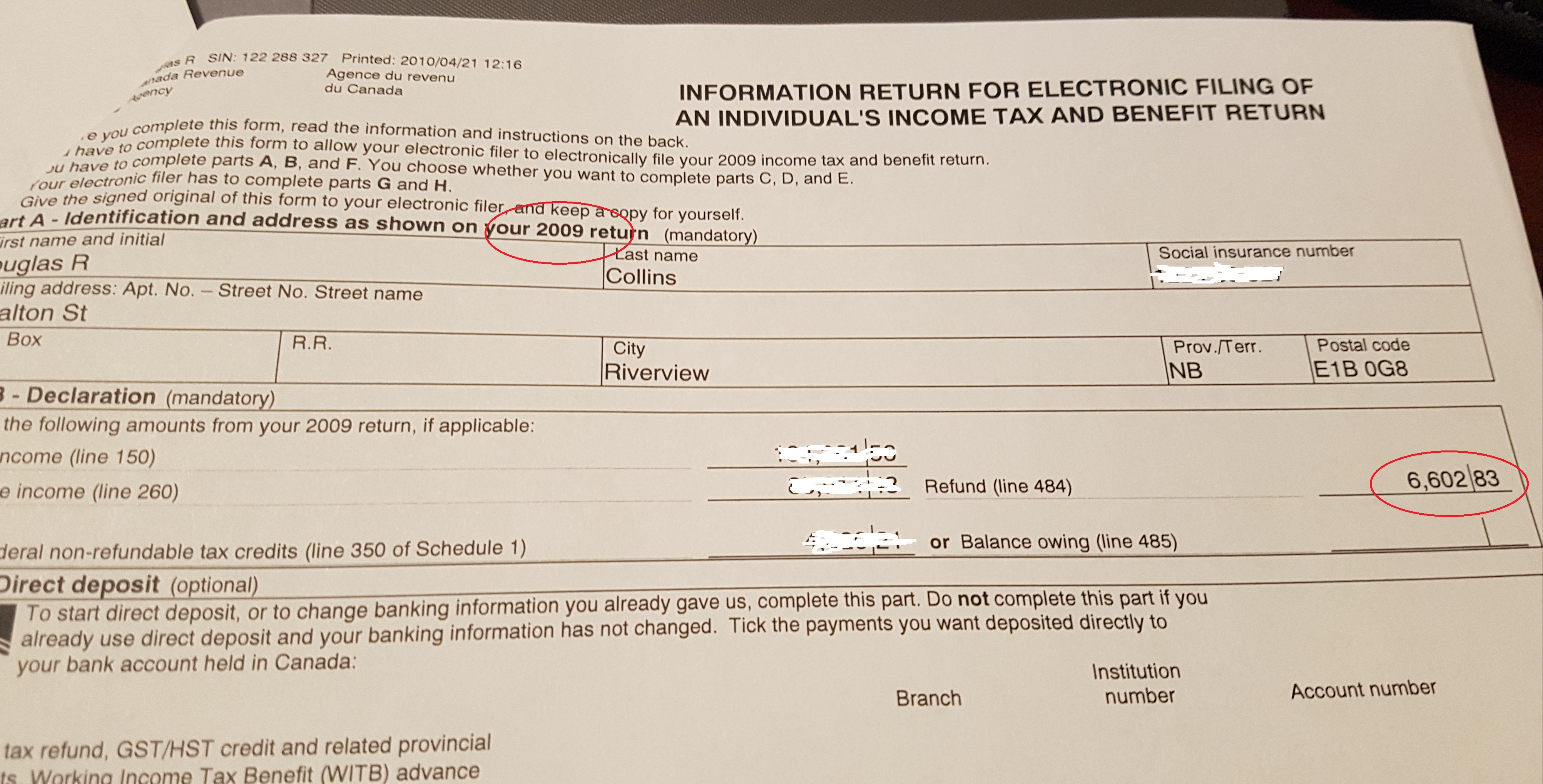

Get a $6,600 Tax Refund Claiming Home Business Tax Write-Offs

Jul 08, 2022

I started my first home business in the late 1990’s. From 2005 to 2008 "life got in the way", and I took a break from having a side business to focus on family and my corporate career. I always imagined that someday I would find the right opportunity and get back into business again someday.

Those were some busy years that included a marriage breakdown, personal bankruptcy, raising three young kids as single dad and being a corporate executive travelling 2 weeks per month. To top it off, the direct sales company I had partnered with the years leading up to this went out of business.

The Turning Point Started in 2008

In 2008, I was introduced to a direct sales product and became a distributor. That's when my real interest and desire to learn everything I could about home business tax write-offs. That year I kept track of my receipts and paperwork in a file folder. When tax season arrived organizing all those receipts was an overwhelming and intimidating experience.

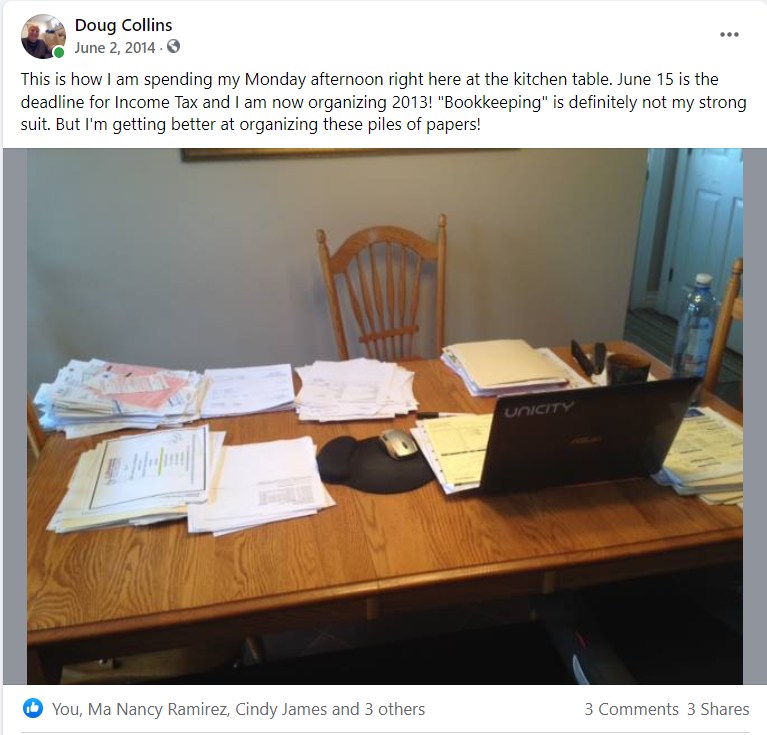

I clearly recall organizing my tax receipts in those early months of 2009, for the 2008 taxation year, as my first year "back in business". I spent many long hours at my kitchen table getting it all sorted out and categorized.

The $6,602.82 Tax Refund Changed Everything

Although I knew I was still missing more receipts and I felt there was tons more potential tax write-offs that I never took advantage of. We can’t change the past all we can do is our best to record what happened. In the end, after filing my personal and home business tax write-offs, that tax year I received a $6,602.83 tax refund. That's when I knew I was on to something.

It all began with that excitement of receiving that tax refund from the tax withheld on my full-time income, simply by leveraging home-based tax write-offs. With my inquisitive nature and interest to learn more, my journey started. That’s when I created the record keeping templates and system that is the base of my online course and coaching system, and that I still use to this day in my own home business.

It Was Not an Easy Road

It took me years to refine these templates and create a simplified system. Unfortunately, I never had a coach or mentor in this area of my business. Someone to reach out to ask questions for support. It seemed like everyone in the home business space had less knowledge than I did. Tax people were of no help either. This is why I am so passionate to help others!

Here is a post from June 2014. Take notice, I am preparing my taxes 6 months into the year for the previous year just days before the deadline.

I want to educate, encourage and clear the confusion out there around home business taxes. I wrote a book for the same purpose. My goal is to shorten the learning curve for those who want to take control of this area of their home business.

I'm Passionate to Help Others Like Me

For those who want more in-depth personalized support and coaching, they can embrace my program. This gives them the proven record keeping system and my personalized one-on-one coaching. I’m here for them and to be that tax strategies and mentor I never had.

You can change your tax paying future FOREVER! Chat soon!

Say Goodbye to Tax Stress

Proven Tax Strategies, Audit-Proof Tools, and Year-Round Support for Home-Based Entrepreneurs