Reduce Your Income Tax & Save Thousands Legally with Home Business Tax Write-Offs

Jul 09, 2022

I often get asked how I can be so confident to say anyone can save THOUSANDS on their income tax each year.

My first experience of really taking home-based income tax strategies seriously was over a decade ago. In 2009, that year instead of owing $5,000 on my corporate income, I received a $6,600 TAX REFUND. Thanks to the tax write-offs I claimed as a result of having a little part-time side business I started the year before.

Since then, I’ve made it my mission to learn EVERYTHING about home business tax write-offs. I’ve spent tens of thousands of hours of studying and applying this knowledge to my home business. I’ve also spoken with tax specialists, auditors, tax lawyers, financial advisers and accountants.

A few years ago, I even won an audit representing myself against CRA that a top tax auditor advised me there was no chance of winning. While I did this for my own financial health as part of my home business, I also has a passion for sharing this knowledge with others who have a home business.

In sharing this with other home business owners I had never met anyone who did not learn something new. Just a nugget of new knowledge can save hundreds and even thousands annually on their income tax!

The Evidence in The Results

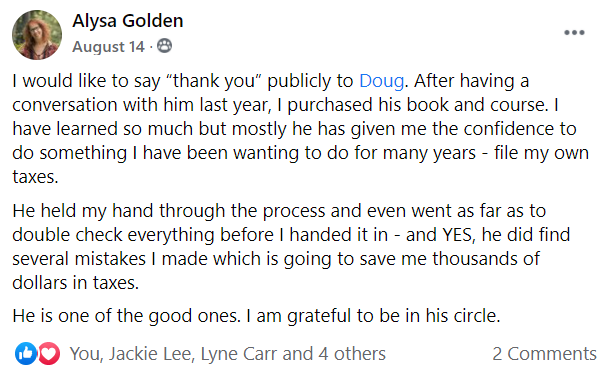

I recently worked with Alysa Golden, who has a home-based business as a Clinical Counsellor and Business Coach for Mental Health Practitioners. She is based on Toronto, Ontario.

In December 2020 after a call, we had to talk about her situation she made the decision to enroll in the course and get my support. At that time, she felt she was disorganized, overwhelmed, procrastinating, and she dreading taxes not knowing what to do next.

As a result of this experience, she gained the tools and confidence. She even filed her our taxes for 2020 resulting in a savings of over $6,000 in income tax. This experience has changed her tax paying future forever! In the below video Alysa shares, more about this experience working together.

Here is what Alysa posted inside the Home Business Tax Secrets Facebook Group:

What others are saying:

- "The course was most informative, and I feel the information learned will be fairly easy to implement into my business practices. Thanks so much Doug!"

- "I expect my tax refund to be considerably more on the plus side after all the great tips I have learned from this course"

- "Use of notebook, calendar, tracking sheet and monthly summaries will help keep my business in order and prepared for any possible tax audits."

- "I found it easy to follow along with. I now see easier ways of keeping track of my records."

Say Goodbye to Tax Stress

Proven Tax Strategies, Audit-Proof Tools, and Year-Round Support for Home-Based Entrepreneurs