Your Tax Preparer Is Giving You Bad Advice: Home Business Tax Write-Offs

Jul 18, 2022

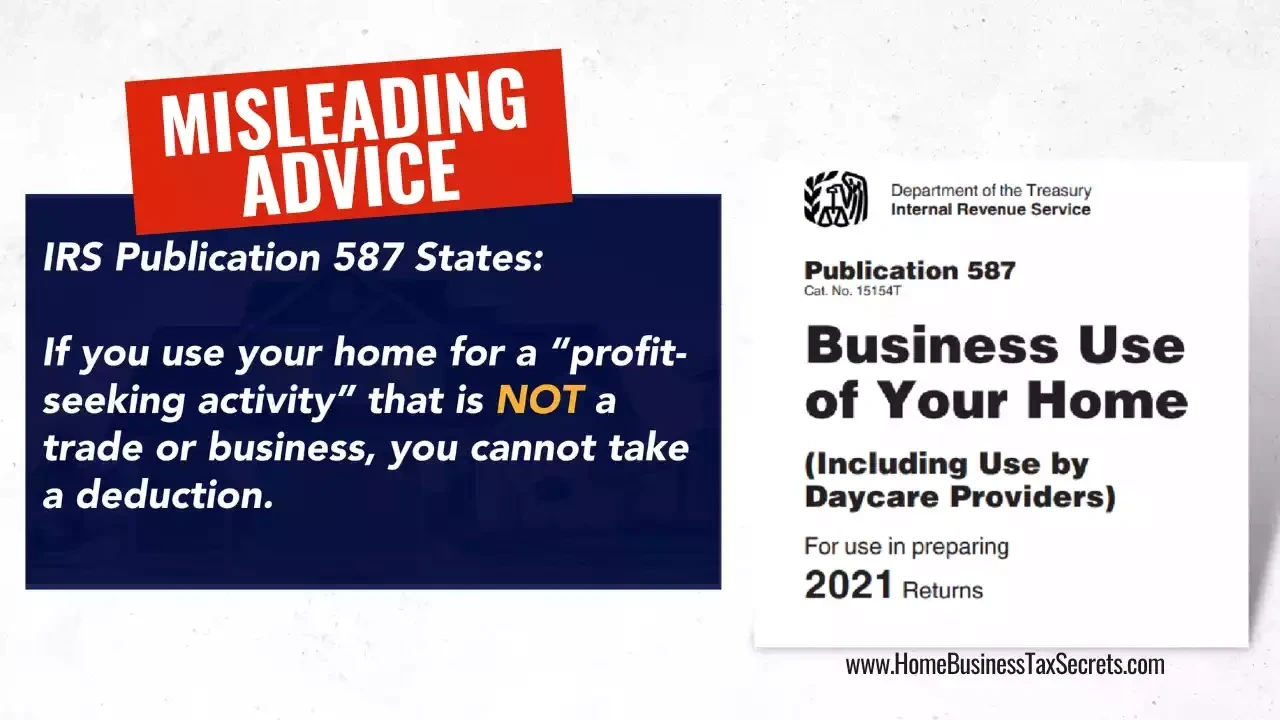

I noticed this image posted on the social media page of a bookkeeping and accounting service provider. Their statement about the IRS Publication is misleading and has likely caused many to believe they are unable to claim tax write-offs, resulting in them missing out on THOUSANDS of savings!

Having read the IRS Publication 587 (Business Use of Your Home) this service bookkeeping provider has taken it out of context and is incorrectly using this as a blanket statement!

The IRS publication actually states you cannot write-off the entire home including "such things as mortgage interest, real estate taxes, utilities, maintenance, rent, depreciation, or property insurance, as business expenses. However, you may be able to deduct expenses related to the business use of part of your home". This is a 35-page document. Most people will not read it, let alone even know it even exists.

In order to claim these deductions, you must meet all the criteria of a trade or business (home-based business) in the home. Although this is an IRS publication for the United States, in Canada with CRA (Canada Revenue Agency) similar rules apply for Business Use of Home Expenses.

So, what is "not a trade or business" if it is still a profit seeking activity?

Let's say for example, you were investing your own money into stocks or bonds then that technically is not "a business, but you were doing it for a profit. But if you were also teaching or coaching others to invest in stocks (for a profit) then that could qualify as a for-profit venture as a business.

According to Investopedia, the term "BUSINESS" refers to an organization or enterprising entity engaged in commercial, industrial, or professional activities. The purpose of a business is to organize some sort of economic production (of goods or services). Businesses can be for-profit entities or non-profit organizations fulfilling a charitable mission or furthering a social cause. Businesses range in scale and scope from sole proprietorships to large, international corporations. Business also refers to the efforts and activities undertaken by individuals to produce and sell goods and services for profit.

Avoid Overpaying Your Taxes Again This Year

Sadly, so many accountants and tax preparers see many activities from home as a hobby and discourage their clients from claiming it on their taxes. Especially when they are not yet generating an income and they have not done a good job of record keeping. This is often the case for most aspiring home entrepreneurs in the direct sales and network marketing industry.

This is such an important topic that I dedicated an entire Chapter to it in my book, titled "Your Tax Preparer is Giving You Bad Advice". In that chapter, I also outline the criteria you should use when finding someone to file your income taxes if you choose to not do that yourself.

According to an article in Forbes online, they stated, "Most tax preparers aren’t the tax experts everyone thinks they are" and the article went on to report these facts:

- According to David Ramsey, “Every year, more than 2 million taxpayers overpay their income taxes—and we’re not talking about pocket change.”

- Forbes says 93% of business owners overpay their taxes – even those with high dollar CPA's. Too many tax advisors just don’t know or care about all the opportunities in the 70,000-page tax rules, and their clients can pay dearly because of it. What does that mean to you? It means if you own a business, there’s a 93% chance you are bleeding needless family wealth by paying way too much tax.

- Even the Federal Government admits business owners overpay their taxes by $50 billion each year!

- A CPA/tax lawyer writing for Kiplinger’s blames CPA ignorance and laziness for wasting countless wealth to avoidable taxes. When you ask the question “What can I do to reduce my tax bill, if the accountant’s response is that they’re already doing everything they can do, it’s probably time to find someone else.”

What Can You Do Starting Now

My advice to everyone in a home-based business is to take ownership of this area of your business. It is important to know what you can and cannot claim, to claim every that is available to you as a business and make yourself audit-proof with your record keeping.

Don't just leave it to someone else. This is your home business - be mindful of where you are getting advice.

This is why I created an online course for home-based business with easy-to-use record keeping templates. It's specifically designed to help those in home-based business to avoid these unfortunate situations so they can change their tax paying futures forever!

Say Goodbye to Tax Stress

Proven Tax Strategies, Audit-Proof Tools, and Year-Round Support for Home-Based Entrepreneurs