From Side Hustle to Tax Trouble? What Every Gig Worker Must Know

Tax Agencies Are Cracking Down on Gig Income—Don’t Get Caught Off Guard

For years, gig workers have operated in a gray area—earning extra cash without much concern for taxes. But in 2025, that’s changing.

If you drive for Uber, sell on Etsy, or freelance online, your earnings are now automatically reported to tax authorities. Underreporting income or missing key write-offs could now lead to hefty tax bills or penalties.

The Gig Economy Boom and Tax Crackdown

The gig economy has exploded in recent years, fueled by rising living costs and a demand for flexible income. For many, gig work is now either a full-time career or a side hustle to make ends meet.

Millions have turned to gig work to supplement their income or replace traditional jobs. Some of the most popular gig roles include:

- Rideshare & Delivery: Uber, Lyft, DoorDash

- Freelancing & Digital Work: Writing, design, virtual assistance

- Online Selling: Etsy, eBay, Amazon

- Home Services: Cleaning, pet care

In a recent article reported by HR Reporter stated that the most common reason Canadians are engaging in gig work is the increased cost of living, cited by nearly one-third (31%) of gig workers.

The IRS and CRA are tightening the rules, ensuring gig income is fully taxed. If you’re not prepared, you could end up paying more than you need to—or worse, facing an audit.

2025 Tax Changes: What Gig Workers Need to Know

Tax agencies are rolling out stricter reporting rules and enforcement measures to capture more gig income.

Here’s what you need to know to protect yourself.

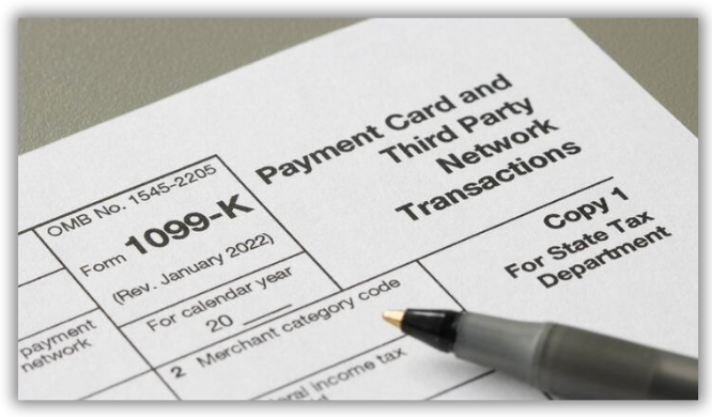

U.S.: Lower 1099-K Reporting Threshold & Penalty Crackdown

Payment platforms like PayPal and Venmo are also reporting transactions, so the IRS knows what you earn.

Previously, third-party payment platforms (PayPal, Venmo, Etsy, etc.) only issued a 1099-K if you earned over $20,000 and had 200+ transactions.

That’s no longer the case as this income amount is changing:

- 2024: $5,000 threshold

- 2025: $2,500 threshold

- 2026 & beyond: $600 threshold

Even if you don’t receive a 1099-K, all gig income is taxable and must be reported. The IRS is stepping up enforcement, and missing income could trigger penalties.

Other crackdowns by the IRS are that penalties for underpaying taxes have tripled, making quarterly tax payments more critical than ever. The IRS interest penalty for underpayment of estimated taxes has risen sharply, roughly tripling over the past couple of years.

Canada: Bill C-47 Puts Gig Income Under the Microscope

In Canada, new tax rules under Bill C-47 require platforms like Uber, DoorDash, and Airbnb must to report gig worker income directly to the CRA. If you earn more than $2,800 from 30+ transactions, your details will be automatically reported.

Starting January 31, 2025, platform operators must submit information returns on their users’ earnings, meaning the CRA will cross-check what you report. Any discrepancies could trigger an audit.

Tax agencies are making sure gig workers report every dollar earned. If you don’t have a tax strategy, you could be paying more than necessary—or facing serious penalties.

Here’s What That Means for Gig Workers

Too many gig workers think taxes only mean reporting income—but that’s only half the equation. If you haven’t reported gig income correctly in the past, now is the time to get on track—before penalties get worse.

The good news? Gig workers are legally self-employed, meaning they qualify for the same tax deductions as any small business.

With the right tax strategy, they can claim tax write-offs that will lower your taxable income.

If you’re a gig worker and not tracking and claiming tax write-offs, you’re handing over thousands of extra income tax dollars to the IRS or CRA.

H&R Block Survey Results

In March 2023, an H&R Block commissioned survey found that 23% of gig workers did not have a clear understanding of the tax implications of gig work.

The survey highlighted a general lack of knowledge among gig economy participants regarding taxes – for example, many were unaware of deductions or the need to report all income.

A follow-up H&R Block survey in early 2025 indicated the percentage of confused gig workers had grown with 37% of gig workers said they were unclear on the tax implications of their gig income.

This suggests that as the gig economy expands, a substantial portion of workers remain uncertain about tax rules (possibly due to new reporting changes). Similarly, in the U.S., other surveys have echoed that many gig workers feel unprepared for taxes.

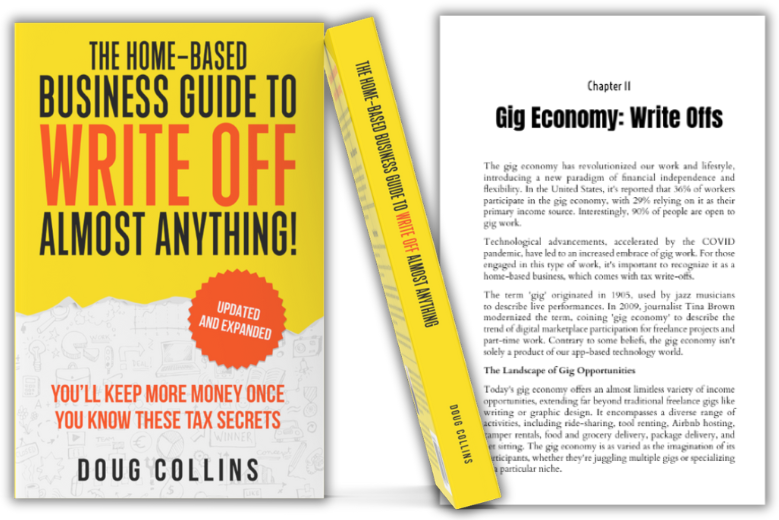

That’s why I dedicated Chapter 11 of my 'Updated and Expanded' second edition of my book, The Home-Based Business Guide to Write Off Almost Anything, to gig worker tax strategies.

Real-World Exampless: A Costly Tax Surprise

From owing $1,700 in income tax to just $26

One gig worker I coached earned $10,000 through Instacart in 2023. Because they didn’t track expenses or understand self-employment taxes, they were shocked to owe $1,700 in taxes. After applying the strategies in the book and following my Tax Write-Offs Made Simple System, they pulled together audit-proof records and reduced their tax bill to just $26.

Another common mistake? Not realizing gig work is considered a business.

Last year, I prepared a tax return for a newcomer to Canada through my volunteer work serving low-income individuals, seniors, students, and newcomers. This year, he reached out again to file his return, but after reviewing his tax profile, I had to decline. In August and September 2024, he earned around $2,000 driving for Uber—and like many entering the gig economy, he had no idea that even small amounts of gig income require filing as a sole proprieter small business.

He also sent me his gas receipts for this time period, assuming he could deduct 100% of the cost. I had to explain the rules around mileage tracking and only the portion used for business is deductible, and he could also claim a percentage of other vehicle expenses like insurance and maintenance, and a number of expenses as a small business.

This is where so many gig workers go wrong. They treat gig income as “extra cash” without realizing they’re now considered self-employed in the eyes of the CRA or IRS.

The IRS and CRA considers you self-employed if you provide services with an expectation of profit, which covers virtually all gig work. Without a tax strategy, gig workers risk overpaying in taxes—or worse, getting penalized for incorrect filings or face a tax audit.

How to Protect Yourself—and Pay Less in Taxes

Keep in mind that reporting your gig income can actually benefit you too – it allows you to deduct business expenses (tax write-offs) against that income that can significantly lower your taxable income.

But the bottom line is that all gig income is reportable and with tax agencies watching more closely than ever, proactive tax planning is the only way to avoid overpaying or getting penalized. Here’s how to stay ahead:

- Keep detailed records of all income, even if you don’t receive a tax form, and compare your records with reports from gig platforms to catch discrepancies before the IRS or CRA does.

- Many gig workers only claim the common and obvious tax write-off, overlooking numerous allowable self employed expenses that could significantly reduce their tax bill.

- Tracking and claiming every write-off you qualify for ensures you keep more of what you earn.

Gig Workers: Take Control Before Filing Your Taxes

The gig economy offers freedom and flexibility—but without the right tax strategy, it can also lead to costly mistakes, penalties, and overpaid taxes.

With tax agencies tracking gig income like never before, now is the time to:

- Get organized: track your income and expenses throughout the year.

- Maximize your write-offs: claim every eligible write-off to reduce your tax bill.

- Stay compliant: avoid penalties by understanding new tax rules.

Want to handle your taxes with confidence?

That's exactly why I wrote The Home-Based Business Guide to Write Off Almost Anything. Inside, you’ll learn how to legally reduce your tax bill, claim overlooked deductions, and stay audit-proof.

Need personanalized support and guidance? My Home Business Tax Secrets Community provides step-by-step guidance, expert resources, and direct support so you can file correctly, avoid penalties, and keep more of what you earn.

Responses