Why Income Diversification Is the Key to Financial Security

A five-week suspension in mid-2022 exposed my risks of relying on a single income stream, and that inspired me to pivot toward building a more resilient and diversified financial future.

Imagine living your dream—running a growing direct sales business and earning a full-time income. You’ve built a global customer base in over 10 countries that offers a passive income and provides financial stability, all while working at home on your own terms.

Then, one Friday afternoon, it all comes crashing down. Without warning, your income stops—that was my wake-up call in mid-2022.

A Defining Moment That Changed Everything

Despite years of hard work and dedication, that’s when I realized that I didn’t truly own this income source. My success—built on integrity and customer first focus helping others—was still vulnerable to factors outside my control, like internal corporate politics and unethical tactics of others.

In this newsletter, I want to share the story of that defining moment, the lessons I’ve learned, and how I’ve since pivoted as a home-based entrepreneur to leverage balanced income security—and that reflects my passion, skills, and the desire to serve others.

Relying on an Income Source You Don’t Own

The Day Everything Changed

On a Friday afternoon in mid-2022, I received an email that changed everything: "Your distributorship has been suspended pending an investigation." My income was frozen, I was locked out of my online account, leaving hundreds of customers unsupported and my future unknown. Despite being in the top 5% of earners in the company, based on income disclosure statements, I realized my success wasn’t secure.

My business income—built over a decade with integrity and a customer-first approach—was suddenly at the mercy of corporate decisions and compliance policies. This wasn’t the first time I’d faced income vulnerability, but it was a wake-up call that pushed me to rethink my approach.

I contested the allegations as baseless with a very detailed 23-page response, but the uncertainty surrounding the future of my income weighed heavily during what dragged on as a five-week suspension, as I waited and wait for a response.

A Harsh Reality Check

This experience wasn’t just about the suspension itself—it was a stark reminder of the risks of relying on a single income stream. It exposed not only my income vulnerabilities but also the systemic flaws of the direct sales income model, forcing me to confront the reality of how little control I truly had on the security of this income.

The Unique Challenges of Direct Sales Income

From the start, I approached my direct sales business differently than many in the network marketing industry. I prioritized a product-first strategy—branding myself, empowering customers through education, creating resources and tools to enhance, and building trust for long-term value.

Facing Risks Beyond My Control

My focus was never on recruitment, selling friends or family, or making overpromised lifestyles claims. Despite my success, I now faced risks I had no control over, as demonstrated by that five-week suspension in 2022, knowing that my income and access to my distributor account could be suspended or terminated without warning was not a good feeling.

Despite all this, the systemic issues within the industry became even more evident, with others plagiarizing my content, poaching my customers, and blatantly violating compliance rules without facing consequences themselves, while I was required to follow a different set of meticulously adhered "unwritten policies and guidelines" to finally have my distributor account restored.

These frustrations weren’t just challenges—they were the wake-up call.

Diversifying Through Passion and Purpose

After years of relying heavily on a single income stream, I realized it was time to take control of my financial future. This inspired me to begin a journey to pivot—not just to protect my income but to build something I could truly own and could be proud of. I wanted to create a business that reflected my passion, aligned with my values, and addressed a real need in the marketplace.

Laying the Groundwork for Change

Doubling Down Before the Pivot

In 2023, I doubled down on my focus with my direct sales business, aiming to lay a strong foundation as I transitioned away from it to pivot into 2024. During this time, I wrote over 100 articles, self-published a book that I mailed out to hundreds of copies to my clients customers around the world with a personal note of appreciation for them, and I created two eBooks.

Building on this foundation, I recognized the need to invest in myself as I also shifted my focus. I enrolled in coaching and training programs to strengthen my authority in the online education space, doubling down on my passion for helping home-based entrepreneurs navigate income taxes, maximize their write-offs, and reduce tax stress.

2024: The Year of Transformation

I began 2024 with a clear focus on expanding my Home Business Tax Secrets brand—a side passion project I had nurtured for years and was now fully committed to bringing to its full potential.

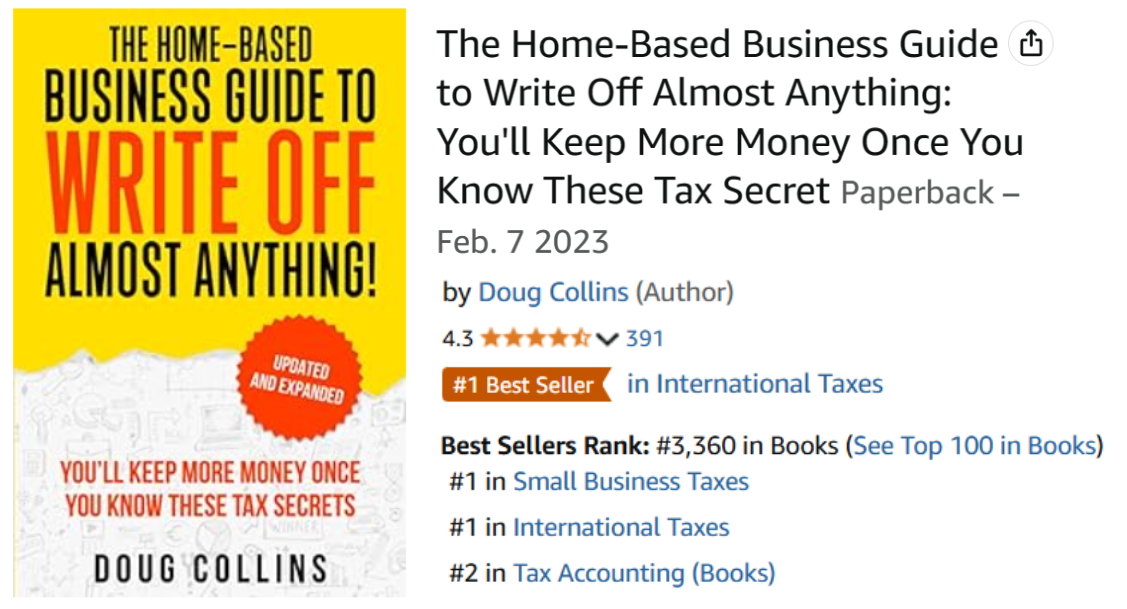

This included a complete review of the latest print edition, updated as of August 2024, of the Updated and Expanded Second Edition of The Home-Based Business Guide to Write Off Almost Anything that now includes new chapters and additional resources to help readers capture every eligible tax write-off.

The success of the book laid the foundation for a suite of complementary tools to simplify tax season for home-based entrepreneurs. From the Tax Preparation Checklist to the Tax Write-Offs Workbook, each resource was developed in response to readers’ needs and feedback.

By the end of 2024, I realized that home-based entrepreneurs needed more than a one-time course that I was offering. Many desired ongoing support as their businesses grew, tax needs evolved, and questions arose throughout the year - as there was no support for them. This inspired a pivot in late 2024 to create the Home Business Tax Secrets Membership.

By offering an affordable, high-value subscription model, the Membership ensures home-based entrepreneurs have year-round access to the tools and support they need to navigate their taxes confidently.

Milestones That Reflect Impact

The results speak for themselves. Despite a reduction in my direct sales income in 2024 due to a shift in focus, I replaced that loss with a new, diversified income stream while significantly improving my total net income after expenses.

The Home-Based Business Guide to Write Off Almost Anything continues to hit the #1 Best Seller list on Amazon, and on January 9, 2025 was ranked #3,360 across all books on the platform.

This milestone reflects the growing impact of the book as it continues to help thousands of home-based entrepreneurs maximize their tax write-offs and keep more of their hard-earned money.

Why Diversification Matters

The lesson I learned in 2022 was clear: relying on a single income stream—especially one in the direct sales industry—is risky. While self-employment offers freedom and flexibility, it also comes with unique challenges.

Resilience Through Diversification

Diversifying your income isn’t just about stability; it’s about resilience. It gives you the ability to weather unexpected disruptions, pivot when needed, and explore opportunities that more align with your passions.

By creating multiple income streams, you’re not only safeguarding your financial future but also opening doors to greater freedom and control.

For me, shifting my focus to my Home Business Tax Secrets brand wasn’t just a financial decision—it was a chance to expand my impact and follow a deeper passion.

I now have a fully developed platform that supports home-based entrepreneurs reduce tax stress, save thousands in taxes, and feel confident about their taxes. At the same time, I’ve created a more balanced and secure income portfolio with a business income asset I truly own.

What About Your Income Stability?

Are you diversified enough to weather unexpected changes?

Now might be the time to explore a new passion, start a side hustle, or develop additional skills to safeguard your future.

I hope my story shows what’s possible when you focus on what you can control and take action.

As I look ahead to 2025, my focus is on creating even greater impact for home-based entrepreneurs who want to build sustainable income, and expand their impact while paying as little income tax as possible.

Take Control of Your Financial Future

Maybe its time for you to act now. Are you ready to future-proof your business income? Start exploring your options, take control, and create a foundation for lasting financial stability.

If you have questions or would like to connect privately to discuss your challenges, I’d love to hear from you. Leave a comment or reach out—I’m here to help.

P.S. Feeling unsure about your financial future? My book, 'The Home-Based Business Guide to Write Off Almost Anything,' is a great first step to understanding the unique tax advantages of operating a home-based business. Available on Amazon.

P.P.S. Ready to take your home-based business to the next level? Join the Home Business Tax Secrets Membership for exclusive resources, live Q&A tax clinics, and year-round support to save thousands in income tax annually, stay audit-proof and stress-free.

Responses